Claiming of GST Input Tax Credit can sometimes be a tricky business. Claiming ITC on Job Work is one such instance where businesses struggle to claim the eligible Input Tax Credit. Many manufacturers outsource their tasks to a third party, and it can create confusion while utilizing ITC.

To claim Input Tax Credit in Job-Work, taxpayers must fill out the ITC-04 form. We have discussed the basics of ITC-04 in this article.

In this comprehensive article, we will look at the basic details of a ‘Job Work’ & also help you understand the process to claim ITC on Job Work easily.

Understanding ‘Job Work’ under GST

What is a ‘Job Work’?

Section 2(68) of the CGST Act of 2017 defines ‘Job Work’ as ‘any treatment or process undertaken by a person on goods belonging to another registered person.

To simplify, Job Work is the processing of the raw materials or unfinished goods supplied by the manufacturer to the Job worker.

Who is a Job Worker?

Let us understand this with an example:

A furniture manufacturer ‘Hari Traders’ outsources some of its work to small scale businesses like furniture polishing, painting, etc.

Hari Traders is currently working on a large order of around 100 sofa sets. These sofas are to be made out of wood.

To build a sofa, the raw wood has to be cut and be given the shape and form of a sofa set.

Hari traders cut and carve out a sofa from the raw wood. But this sofa is still an UNFINISHED good.

Further, this sofa has to go through:

- Polishing

- Painting

- Finishing, etc.

Hari Traders then gives the table for a ‘paint job’ to a small wood painting business in the town called ‘Anjali Paints’.

In this example:

‘Hari Traders’ has outsourced the tasks on his UNFINISHED goods to a third party called ‘Anjali Paints’.

According to the definition stated in the CGST Act of 2017,

Hari Traders is the Principal &

Anjali Paints is the Job Worker.

Here, ‘Hari Traders’ is a GST registered business.

‘Anjali Paints‘ has taken on the goods from this registered person to carry out some other painting and polishing processes.

This makes ‘Anjali Paints’ a ‘Job Worker’ as it has taken a job from a registered business.

Provisions to claim ITC on Job Work

Section 19 of the CGST Act of 2017 explains claiming Input Tax Credit under GST on the ‘Job-work’ that is outsourced to another party by the original manufacturer (Principal).

As per Section 19 of the CGST Act, the Principal manufacturer can avail of the eligible Input Tax Credit on the GST paid on the inputs he has SENT to the ‘Job Worker’.

It is also explicitly stated that the Principal manufacturer should be able to avail the eligible ITC, even if the goods are directly supplied to the Job Worker without the Principal manufacturer even receiving them at the Principal place of business.

What is the time duration within which the Principal should receive the goods back?

To avail eligible Input Tax Credit on the goods sent to the ‘Job-Worker’, these goods must be received within the specified time frame.

The time frame is as given below:

- For CAPITAL GOODS – Within THREE years from the date when the goods were sent to the Job Worker.

- b. For INPUT GOODS – Within ONE year from the date when the goods were sent to the Job Worker.

How is this effective date calculated?

The effective date to calculate the time frame to avail ITC is the date when the goods are sent to the job worker by the Principal from his registered place of business.

If the unfinished goods are directly sent to the job worker from the supplier of the ‘Principal’, then the ‘date of receipt of unfinished goods by the job worker is considered the effective date.

What if the finished goods are NOT received from the job worker within the specified time?

If the Principal does NOT receive the goods within the specified time, then the goods are deemed as supply from the effective date.

The ‘Principal’ has to pay tax on this deemed supply & the GST Challan issued is considered the invoice receipt for this deemed supply.

Form GST ITC-04

Form GST ITC-04 must be filed to avail the Input Tax Credit on the Job Work.

Form GST ITC-04 should be submitted by the ‘Principal’ manufacturer every quarter.

The Principal manufacturer must furnish the Challan details for the following transactions:

- Unfinished goods sent to the Job Worker

- Goods received from the job worker

- Goods transferred from one job worker to another.

Form ITC-04 Due Dates

The Principal manufacturer files Form ITC-04.

ITC-04 should be filed on or before the 25th day of the month, succeeding the end of the quarter.

For example: For the quarter of July’22 – September’22, the due date is 25th October 2022.

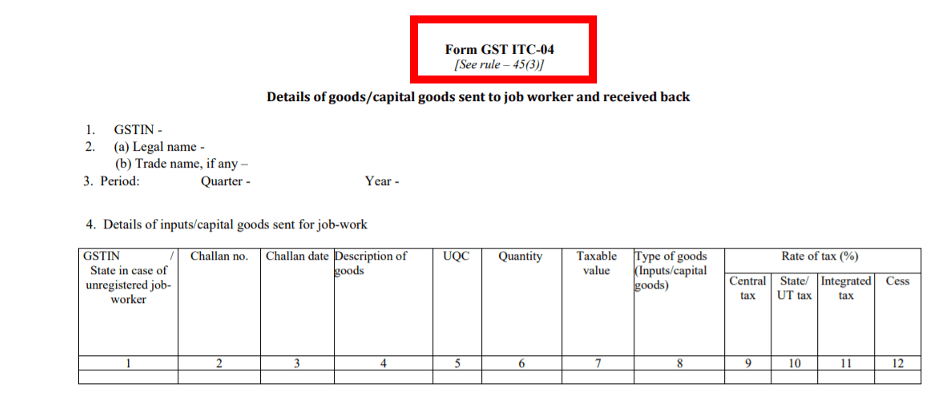

Form ITC-04- Details required

The information to be furnished in the ITC-04 is categorized into two major parts:

- Goods sent to the job worker

- Goods received from the job worker.

GST ITC-04 form looks as follows:

1.Details of input/capital goods sent for job-work:

This section captures the following details:

- GSTIN

- Challan number

- Description of goods

- Types of capital goods

- Rate of tax

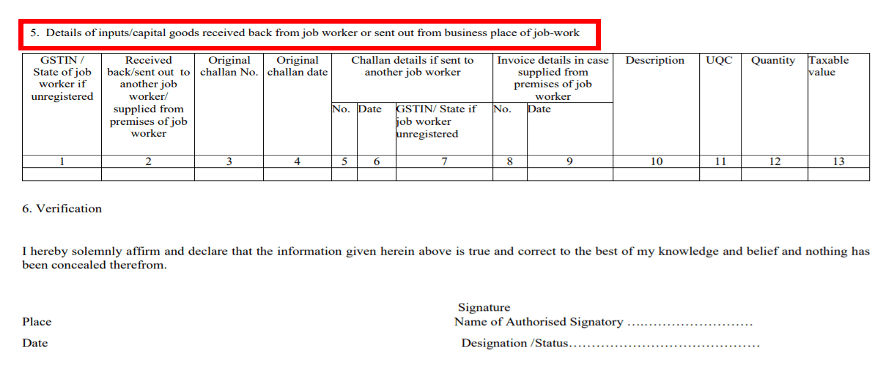

2.Details of input/capital goods received back from the job-worker

This section captures the details of the goods received by the Principal Manufacturer or sent them to another job-worker directly.

Claim 100% ITC – Go Automated

We can agree that there are many challenges in front of businesses claiming eligible Input Tax Credit, and the most common reason behind this is the GST non-compliance either by themselves or their vendors.

Claiming of 100% Input Tax Credit can be a tricky business when there are multiple GST registrations under a single PAN.

Hence, businesses are advised to use automated ITC reconciliation platforms like KYSS.

The automated GST filing solutions like KYSS allows you to:

- Hassle-free GST returns filing.

- Automated reconciliations to identify errors and file 100% accurate GST returns.

- Claim 100% eligible GST Input Tax Credit and stay away from the ineligible ITC under GST.

- Identify the defaulting GST suppliers by uploading supplier data in bulk.

- Generates a comprehensive report and sends them to the concerned stakeholders.

- Automated notifications to the identified GST defaulting supplier.

- Authentic GST data – directly fetched from the GSTN portal.

- Frequent follow-ups – The automated tracker works on data-driven insights. Hence, for a non-responsive supplier, regular follow-ups will be scheduled.

Hence, to claim only the eligible ITC and identify the defaulting suppliers, KYSS will provide you with a robust & friendly infrastructure to help you increase profitability and save your time.

The number of outsourcing activities in India is enormous. Hence, a large amount of ITC gets involved in these transactions. The businesses outsourcing their jobs to other vendors may lose out on their Input Credit if it is NOT availed in the right way and at the right time.

But taxpayers should note that claiming any ineligible Input Tax Credit can put your business in trouble and block your working capital. That is where automated ITC reconciliation tools like KYSS come into the picture.

Go automated & claim 100% eligible ITC without any hassle!